Stay Informed

Change in the financial planning landscape is a given. We routinely post content that will help you stay current with legislative topics, financial planning tools, and everything you want to know about retirement strategies.

SIGN UP FOR UPDATES

Ah, we restless humans. Sometimes, it pays to strive for greener grass. But as an investor, second-guessing a stable strategy can leave you in the weeds. Trading in reaction to excitement or fear tricks you into buying high (chasing popular

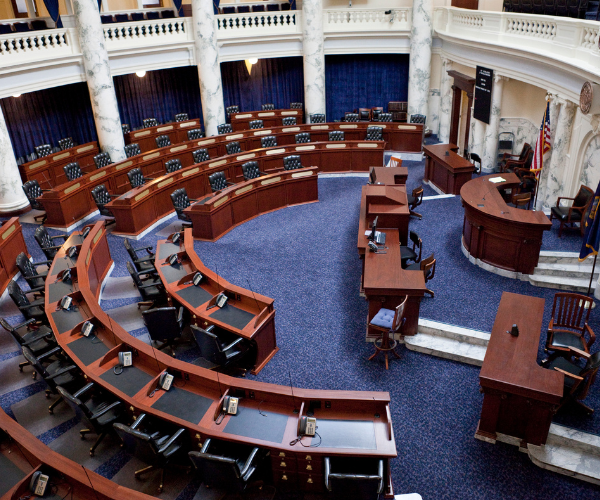

Members of the House of Representatives recently raised concerns regarding the Department of Labor’s EBSA investigations into plan sponsors, citing them as lengthy and burdensome, and called for reform. In a Sept. 19 letter to Acting Labor Secretary Julie Su,

Sound investment decisions are rarely made under the weight of worry. The field of behavioral finance points to a number of cognitive distortions that feed on investor fear – including 401(k) fears – and can plague participants’ decision-making while compromising

If you think about it, “reflection” is an interesting word. Depending on the context, it can mean gazing backward in time, inward to your personal core, or outward at how others perceive you. Regardless of the view, we believe there’s

In a bit of a paradox, you’ll find the following two titles on our recommended reading list: The Wisdom of Crowds, James Surowiecki (2005) Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, Charles Mackay (1852) So, which is

In September, the U.S. Federal Reserve announced it would hold interest rates steady for now but signaled at least one more hike may lie ahead before the end of the year. Moreover, rates are likely to stay elevated, as the

As financial advisors, we help people attain financial independence. Usually, our personalized planning conversations are enough to help them establish a healthy, happy relationship with their money. But sometimes, we uncover bigger pain points we need to move past before

1. How does the SECURE 2.0 Act affect my current participants? Employer Matching Contributions as designated Roth contributions: An optional provision, which has now been delayed until January 1, 2026. Participants may choose, plan permitting, to treat employer

Nobody wants to make investment mistakes. And yet, we’re human; mistakes happen. Here’s how to minimize the ones that matter the most, and make the most of the ones that remain. Bad Decisions vs. Bad Outcomes First, let’s define what

As a plan administrator or sponsor, you want to provide your employees with a retirement plan that benefits them while also being beneficial to your company. Safe harbor plans have become a popular option, but some sponsors may be hesitant

You already know a fiduciary must act solely in the interest of the plan participants, their beneficiaries and alternate payees to ensure that only reasonable expenses are being paid. The big question is: how do you know if plan fees

Whether due to disability, dementia, or simply enjoying an exotic vacation, there are many ways you can end up unavailable to make critical financial or healthcare choices for yourself or your loved ones. If you’ve not documented your desires in

Take Control of Your Financial Future with our Expert Advisory Services

Contact us today to schedule a consultation and discover how our expert advisory services can help you achieve your financial goals with confidence and peace of mind. Let us guide you towards a brighter financial future starting today!