Inflation has been the buzz word since the early stages of the COVID-19 pandemic. We all have experienced the frustration of rising prices whether from higher grocery bills, gas prices or virtually anything we want to purchase.

To help combat rising prices, workers typically receive increases in their paychecks. Of course, every company handles raises differently, and they may not offer them at all.

For those not working and receiving Social Security checks, the Social Security Administration annually reviews the rate of inflation and adjusts the amount paid to beneficiaries.

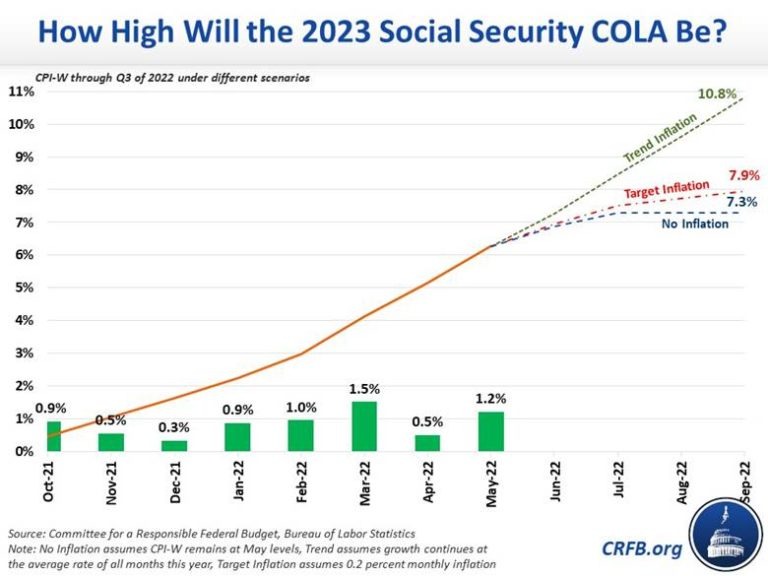

Because the administration calculates the cost-of-living adjustment (COLA) based on inflation, we believe this year retirees could see their monthly benefits increase by an estimated 8%-10%—the largest percentage increase since the early 1980s.

If the administration based the adjustment on August’s annual increase in prices, the current average monthly Social Security retirement benefit of $1,625 would increase to $1,766 starting in January of next year. That would lead to an average total of $21,192 paid to each beneficiary in 2023 compared with $19,500 in 2022—an extra $1,692 for the full calendar year.

Is it enough?

Given how quickly prices have increased, many people wonder if it will be enough to offset the higher prices we currently face. The inflation that everyone experiences is different. For some, an increase like we estimate above could be ample; for others it won’t suffice. This is where having a meaningful conversation with your financial advisor can be helpful. Your advisor can evaluate your personal situation and help you ensure you are on the right track or suggest course corrections to get you back in the right direction.

If you haven’t started receiving your Social Security retirement benefit yet, your advisor can also help you estimate your monthly payments and determine when the optimal time is to start receiving your benefits. Inflation adjustments benefit individuals that haven’t filed yet by increasing the starting benefit amount. In addition to inflation, the administration calculates your payments based on other factors, such as your earnings during your career, the age you started receiving benefits and your birth year.

Given the trends in inflation, it’s clear that Social Security benefits are going up next year to help retirees with higher prices. The Fed has also indicated it will continue to raise interest rates to bring

down inflation. If inflation cools in the new year, we likely won’t be talking about the historically big increase in COLA next year. Instead, we may be talking about how it returned to the low levels of the

last decade.

#SocialSecurityBenefits

#inflation2022

#RetirementIncome

Have questions? Schedule a complimentary 15 minute call to discuss your specific situation: https://calendly.com/jmilliken